UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment (Amendment No. )

Filed by the Registrant x☒

Filed by a Party other than the Registrant ¨☐

Check the appropriate box:

| ☐ | ||||

Preliminary Proxy Statement | ||||

| ☐ | ||||

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| ☒ | ||||

Definitive Proxy Statement | ||||

| ☐ | ||||

Definitive Additional Materials | ||||

| ☐ | ||||

Soliciting Material | ||||

SEALED AIR CORPORATION

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | ||||

No fee required. | ||||

| ☐ |

| |||

| ||||

| ||||

| ||||

| Fee paid previously with preliminary materials. | ||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

President and CEO | |||

| ||||

| ||||

| ||||

|

|

April 8, 201614, 2022

Dear Fellow Stockholder:

It is my pleasure to invite you to attend the Annual Meeting of Stockholders of Sealed Air Corporation scheduled to be held on Thursday, May 19, 201626, 2022, at 10:8:00 a.m., Eastern Time,daylight time. This year’s Annual Meeting will again be a “virtual meeting” conducted via live audio webcast to facilitate broad stockholder attendance and equal participation, from any location around the world, at no cost. Each stockholder will be able to participate in the Crowne Plaza Charlotte Executive ParkAnnual Meeting by accessing a live webcast at 5700 Westpark Drive, Charlotte, North Carolina 28217. Your Boardwww.virtualshareholdermeeting.com/SEE2022 and entering the 16-digit control number included on the stockholder’s Notice of DirectorsInternet Availability of Proxy Materials or proxy card. Stockholders will also be able to vote their shares and senior management look forward to greeting you atsubmit questions via the meeting.Internet during the meeting by participating in the webcast.

At this meeting, youDuring the Annual Meeting, stockholders will be asked to elect the entire Board of Directors of Sealed Air and to ratify the selectionappointment of Ernst & YoungPricewaterhouseCoopers LLP as our independent registered public accounting firmauditor for 2016. In addition, you2022. We also will be asked forasking stockholders to approve, by an advisory vote, to approve our 2021 executive compensation as disclosed in the proxy statement.Proxy Statement for the Annual Meeting. These matters are important, and we urge you to vote in favor of the election of each of the director nominees, our executive compensation and the ratification of the appointment of our independent auditor.auditor, and the approval of our 2021 executive compensation.

For your convenience, we are also offering a webcast of the meeting. If you choose to follow the meeting via webcast, go to http://sealedair.com/investors shortly before the meeting time and follow the instructions to join the event. We will also provide a replay of this meeting for your reference.

This year, as in 2015, we are again taking advantage of the Securities and Exchange Commission rule that allows us to furnishfurnishing proxy materials to our stockholders over the Internet. This e-proxy process expedites stockholders’ receipt of proxy materials, lowers our costs and reduces the environmental impact of ourthe Annual Meeting. Today we sent to most of our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our 2016 proxy statementProxy Statement for the Annual Meeting and 2015 annual report andour 2021 Annual Report to Stockholders, as well as how to vote via the Internet. Other stockholders will receive a copycopies of the Proxy Statement, a proxy statementcard and annual reportthe 2021 Annual Report by mail or e-mail.

Regardless of the number of shares of common stock you own, itIt is important that you vote your shares in personof common stock at the virtual meeting or by proxy.proxy, regardless of the number of shares you own. You will find the instructions for voting on theyour Notice of Internet Availability of Proxy Materials or proxy card. We appreciate your prompt cooperation.attention.

The Board of Directors invites you to participate in the Annual Meeting so that management can discuss business trends with you, listen to your suggestions and answer your questions. Thank you for your continuing support, and we look forward to joining you at Sealed Air’s 2022 Annual Meeting.

Sincerely,

Edward (Ted) L. Doheny II |

Notice of Annual Meeting of Stockholders

Sealed Air Corporation, a Delaware corporation (“Sealed Air”), will hold its Annual Meeting of Stockholders (the “Annual Meeting”) on May 26, 2022, at 8:00 a.m., Eastern daylight time. The Annual Meeting will again be conducted as a virtual meeting via live audio webcast. Each stockholder may participate in the Annual Meeting, including casting votes and submitting questions, by accessing the live audio webcast at www.virtualshareholdermeeting.com/SEE2022 and then using the 16-digit control number provided on the Notice of Internet Availability of Proxy Materials or proxy card being delivered to the stockholder. Online check-in to the Annual Meeting webcast will begin at 7:45 a.m., Eastern daylight time, and stockholders are encouraged to allow ample time to log in to the meeting webcast and test their computer audio system. There will be no physical location for the Annual Meeting.

The purposes for the Annual Meeting are to consider and vote upon:

| 1. | Election of each of the following nominees as Directors: |

Elizabeth M. Adefioye | Zubaid Ahmad | Françoise Colpron | ||

Edward L. Doheny II | Henry R. Keizer | Harry A. Lawton III | ||

Suzanne B. Rowland | Jerry R. Whitaker |

| 2. | Ratification of the appointment of PricewaterhouseCoopers LLP as Sealed Air’s independent auditor for the year ending December 31, 2022 |

| 3. | Approval, as an advisory vote, of 2021 executive compensation as disclosed in the attached Proxy Statement |

| 4. | Such other matters as properly come before the Annual Meeting |

The Board of Directors has fixed the close of business on March 28, 2022 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting. Sealed Air is making available or mailing its 2021 Annual Report to all stockholders of record as of the record date. Additional copies of the 2021 Annual Report are available upon written request to the Corporate Secretary at Sealed Air Corporation, 2415 Cascade Pointe Boulevard, Charlotte, North Carolina 28208.

Because it is important that as many stockholders as possible be represented at the Annual Meeting, stockholders should review the attached Proxy Statement promptly and carefully and then vote. A stockholder may vote by following the instructions for voting set forth on the Notice of Internet Availability of Proxy Materials or proxy card. A stockholder who receives a paper copy of the proxy card by mail will also receive a postage-paid, addressed envelope that can be used to return the completed proxy card. A stockholder who joins the Annual Meeting may vote electronically at the Annual Meeting.

Sealed Air will maintain a list of stockholders of record as of the record date at Sealed Air’s corporate headquarters, 2415 Cascade Pointe Boulevard, Charlotte, North Carolina, for a period of ten days prior to the Annual Meeting.

On behalf of yourthe Board of Directors, we thank you for your ongoing support.

Sincerely,Angel S. Willis

Vice President, General Counsel and Secretary

Jerome A. Peribere

President and

Chief Executive Officer

SEALED AIR CORPORATION

8215 Forest Point Boulevard

Charlotte, North Carolina 28273

April 14, 2022

Important Notice Regarding Availability of Proxy Materials for Annual Meeting on May 26, 2022: Sealed Air’s Notice of Annual Meeting of Stockholders, Proxy Statement and 2021 Annual Report to Stockholders are available at https://ir.sealedair.com/reports-filings/annual-meeting. |

Participation in the Virtual Annual Meeting

Date and Online | Virtual Meeting Webcast Address www.virtualshareholdermeeting.com/SEE2022 | |

The Board of Directors considers the appropriate format of our annual meeting of stockholders on an annual basis. This year the Board again chose a virtual meeting format for the Annual Meeting to facilitate broad stockholder attendance and equal participation, from any location around the world, at no cost. The virtual meeting format will allow our stockholders to engage with us at the Annual Meeting from any geographic location, using any convenient internet-connected devices, including smart phones and tablets, as well as laptop or desktop computers. We will be able to engage with all stockholders as opposed to just those who can afford to travel to an in-person meeting. The virtual format allows stockholders to submit questions and comments during the meeting.

The live audio webcast of the Annual Meeting will be available for listening by the general public, but participation in the Annual Meeting, including voting shares and submitting questions, will be limited to stockholders. To ensure they can participate, stockholders and proxyholders should visit www.virtualshareholdermeeting.com/SEE2022and enter the 16-digit control number included on their Notice of Internet Availability of Proxy Materials or proxy card. If you wish to participate in the meeting and your shares are held in street name, you must obtain, from the broker, bank or other organization that holds your shares, the information required, including a 16-digit control number, in order for you to be able to participate in, and vote at, the Annual Meeting.

If you have any questions or concerns regarding meeting access or procedures prior to the Annual Meeting, please call: 1-704-503-8841 or send emails to investor.relations@sealedair.com. For technical support during the check in or at meeting time, please call: 1-844-986-0822 (toll-free) or 1-303-562-9302 (toll line). |

PROXY STATEMENTStockholders can vote their shares and submit questions via the Internet during the Annual Meeting by accessing the annual meeting website at www.virtualshareholdermeeting.com/SEE2022. Following adjournment of the formal business of the Annual Meeting, we will address appropriate questions from stockholders regarding Sealed Air in the order in which the questions are received. If we receive substantially similar questions, we will group those questions together and provide a single response to avoid repetition. Additional information regarding the submission of questions during the Annual Meeting can be found in our 2022 Annual Meeting Rules of Conduct and Procedure, available at www.virtualshareholdermeeting.com/SEE2022.

| Sealed Air Corporation 2415 Cascade Pointe Boulevard Charlotte, North Carolina 28208 |

Proxy Statement Dated April 8, 201614, 2022

For the 20162022 Annual Meeting of Stockholders

We areSealed Air Corporation, a Delaware corporation, is furnishing this Proxy Statement and related proxy materials in connection with the solicitation by theits Board of Directors of Sealed Air Corporation (“Sealed Air,” the “Company,” “we,” “us” or “our”), a Delaware corporation, of proxies to be voted at our 2016its 2022 Annual Meeting of Stockholders and at any adjournments. We areSealed Air Corporation is providing these materials to the holders of Sealed Airrecord of its common stock, par value $0.10 per share. We areshare, as of the close of business on March 28, 2022 and is first making available or mailing the materials on or about April 8, 2016 to stockholders of record at the close of business on March 21, 2016.14, 2022.

The Annual Meeting is scheduled to be held:held by webcast as follows:

| Thursday, May | |

| ||

| Time | ||

| ||

| Meeting Website Address |

| |

Your vote is important. Please see the detailed information that follows.

| Contents |

| 1 | ||||

| 13 | ||||

| 13 | ||||

| 15 | ||||

| 15 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 35 |

2016Cautionary Statement Regarding Forward-Looking Statements. Certain statements contained in this Proxy SummaryStatement are or may be considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act. We use words such as “anticipate,” “believe, “expect,” “future,” “intend” “strive,” “seek,” “goal,” “may,” “will,” “continue,” “target” and similar expressions to identify forward-looking statements. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. All statements other than purely historical information, including statements regarding our operating model, plans and strategies and our environmental, social and governance goals, made in this document are forward-looking. Forward-looking statements reflect management’s current expectations and are inherently uncertain. Actual outcomes and results may differ materially from those expressed in, or implied by, forward-looking statements due to a variety of factors, including the uncertainties and risks discussed in our 2021 Annual Report on Form 10-K and subsequent Securities and Exchange Commission (“SEC”) filings. You should not place undue reliance on any forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update or revise any forward-looking statements.

Information Referenced in this Proxy Statement. Website references throughout this document are provided for convenience only, and the content of the referenced websites, including the content on our Company website, is not, and shall not be deemed to be, part of this Proxy Statement or incorporated into this Proxy Statement or into any of our other filings with the SEC.

| 2022 Proxy Summary |

This summary highlights information contained elsewhere in this proxy statement.about Sealed Air and the Annual Meeting. This summary does not contain all of the information that you should consider, and you should read the entire proxy statementProxy Statement carefully before voting. References in this Proxy Statement to “Sealed Air,” “SEE,” and “Company,” and to “we,” “us,” “our” and similar terms, refer to Sealed Air Corporation.

Annual Meeting of Stockholders

Time and Date: 8:00 a.m., Eastern daylight time, on May 26, 2022 | Meeting Webcast Address www.virtualshareholdermeeting.com/ | Record Date Close of business on March 28, 2022 |

|

| |

|

| |

|

| |

|

| |

Proposal | Board Recommendation | |||

| 1 | Election of Directors | For each nominee | ||

| 2 | Ratification of Appointment of Independent Auditor for 2022 | For | ||

| 3 | Approval of 2021 Executive Compensation on an Advisory Basis | For | ||

How to Cast Your Vote

You can vote by any of the following methods:

Until 11:59 p.m., EDT, on May 25, 2022

| |||||

| Internet: www.proxyvote.com | ||||

| |||||

| Telephone: +1-800-454-8683if you beneficially own +1-800-690-6903 if you are the stockholder | ||||

| |||||

| By Mail: Completed, signed and returned proxy card | ||||

At the Annual Meeting on May 26, 2022

| Internet: By joining the Annual Meeting at www.virtualshareholdermeeting.com/SEE2022 if you are the stockholder of record or if you hold a proxy from the broker, bank or other nominee holding your shares in street name |

If you participate in our 401(k) and Profit-Sharing Plan, you may use the proxy card to provide voting instructions to Fidelity Management Trust Company, as trustee, and your completed, signed card must be delivered to the trustee by 11:59 p.m., Eastern daylight time, on May 23, 2022.

2022 Proxy Statement | 1 |

| 2022 Proxy Summary |

Our Purpose

We are in business toprotect, to solve critical packaging challenges, and to make our world better than we find it.

We are a leading global provider of packaging solutions integrating high-performance materials, automation, equipment and services. SEE designs and delivers packaging solutions that preserve food, protect goods, automate packaging processes, and enable e-commerce and digital connectivity for packaged goods. Our packaging solutions are designed to help customers automate their operations to be increasingly touchless and more resilient, safer, less wasteful, and enhance brand engagement with consumers.

We deliver our packaging solutions to an array of end markets including fresh proteins, foods, fluids, medical and healthcare, e-commerce, logistics and omnichannel fulfillment operations, and industrials. We serve customers across 114 countries/territories directly and through a diversified distribution network. We aim to deliver savings to our customers and accelerate payback on their investments. We invest in technology and innovation that transform our industry toward a more sustainable future.

Our Vision

To become a world-class, digitally-drivencompanyautomating sustainable packaging solutions.

We are building the SEE Solutions Ecosystem from our operations to our customers’ operations and to consumers, with Automation, Digital and Sustainability driving growth.

2 |

|

| 2022 Proxy Summary |

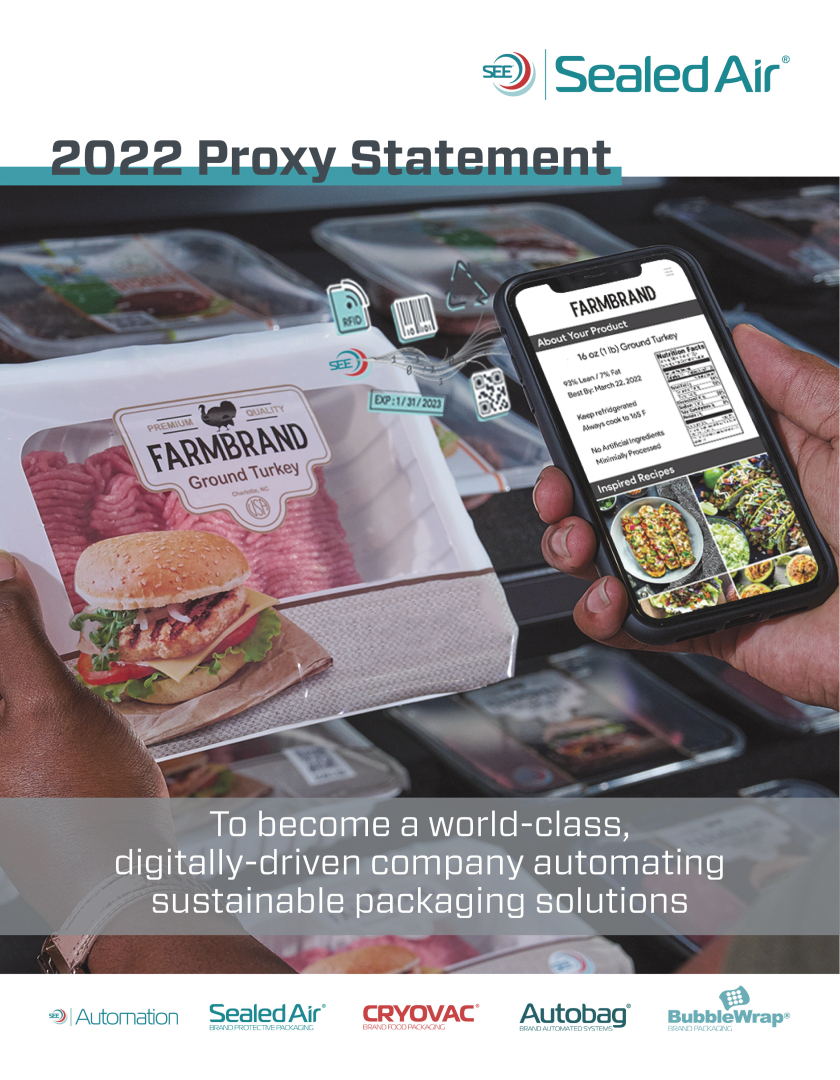

SEE Operating Model: Accelerating to World-Class

We expect the execution of our strategy and the power of the SEE Operating Engine to deliver higher, above market performance. As a result, we have raised our SEE Operating Model annual growth goals as set forth below.

| Sales | 5 to 7% growth | ||

| Earnings | Adj. EBITDA 7 to 9% growth Operating Leverage1 >30% | |||

| EPS | Adj. EPS >10% growth | |||

Cash | >50% FCF conversion2 ROIC > WACC3 | |||

| 1 | Operating Leverage measures the ratio between year over year change in Adjusted EBITDA and the year-over-year change in net trade sales. |

| 2 | FCF conversion is the ratio of free cash flow divided by Adjusted EBITDA. |

| 3 | ROIC means return on invested capital. WACC means weighted average cost of capital. |

Our Strategy

HowSEE caring, high-performance people + digital growth culture

We are bringing people together with a future that is more digitally connected. We prioritize our people and recognize the importance they play in realizing our purpose. Through digital platforms, we are accelerating our efforts to Cast Your Voteretain, attract and motivate top talent, train our leadership teams, develop future leaders, shape a caring, high-performance organization and culture, and drive top benchmark employee engagement.

Creating SEE Touchless Automation™ experience

With our SEE Automation™ solutions, we aim to solve our customers’ automation needs while creating significant return on their investments through savings and increased productivity. We have focused on increasing our equipment offerings which help our customers automate packaging processes. In addition, through our SEE Operating Engine, we are automating our own operations to make them more sustainable and generate productivity savings.

Digital transformation from innovate to solve in our ecosystem

We have launched the MySEE digital e-commerce platform to make doing business with SEE easier and more efficient. We are investing in automation and digital technologies that enhance performance, efficiency and monitoring in customers’ and our own operations. We are developing smart packaging that can enable traceability and deliver digital content. We are investing in digital printing to drive customer savings, generate demand and enhance brand image and shelf impact. We are accelerating our digital transformation by partnering with leading digital companies.

Best solutions, at the right price, and make them sustainable

Sustainability is embedded in our purpose and vision. We have set ambitious environmental goals aimed to lead the industry towards a better future. We are designing high-performance packaging materials with recyclability in mind, to make sustainability more affordable, and to create a pathway for a circular economy. We are transforming our operations and our customers’ operations with SEE Touchless Automation™ which aims to improve efficiency, eliminate waste, simplify processes, and create a safer working environment.

2022 Proxy Statement | 3 |

| 2022 Proxy Summary |

You can vote

Purpose driven capital allocation to create value for our shareholders and society

Our capital allocation strategy fuels the SEE Operating Engine and is rooted in economic value add with the goal to drive profitable, above market organic growth, and attractive returns on invested capital. We invest through capital expenditures, research and development, acquisitions, and other investments aligned with our strategy. SEE Ventures is embedded in our capital allocation strategy, through which we invest in entrepreneurial and disruptive technologies that present opportunities to accelerate innovation and increase speed to market. In addition, dividends and share repurchases are used to return capital to shareholders.

SEE Operating Engine Fueled by anythe 4P’S

People + Digital: SEE caring, high-performance culture

Leveraging the power of operating as One SEE, driving productivity, swarming challenges and opportunities; creating a digital connection between people and the customer experience, both internally and externally; rewarding value creation, executing talent strategies to develop, retain and attract top talent; focusing on diversity, equity and inclusion (DEI) leadership and environmental, social, and governance (ESG) excellence.

Performance: World-class

Outperform the markets we serve through our SEE Operating Engine; create customer references by offering the best service and being “at the table and online” with our customers; execute a purpose-driven capital allocation mindset.

Platforms: Best Solutions, right price, make them sustainable

Focus on leading solutions that generate customer savings; SEE Touchless Automation™ — doing more with less by investing and working smarter; aiming to create significant customer savings.

Processes: SEE Operating Engine

Embed SEE Operating Engine into everything we do, thereby eliminating waste, automating and simplifying processes, and removing people from harm’s way.

Sustainability: Make our world better than we find it

Drive environmental, social, and governance excellence by focusing on achieving goals that aim to make our world better than we find it. SEE is dedicating innovation, research and development resources to design or advance packaging materials to be recyclable or reusable and contain more recycled and or renewable content and has announced a goal to reach net-zero carbon emissions within our operations by 2040.

2021 Highlights

In 2021, we delivered strong sales and earnings, overcoming dramatic inflationary, supply, and COVID challenges. Our results are a testament to our culture, people, and the powerful SEE Operating Engine.

Total Shareholder Return 97.5% ’19-’21 Performance Period | Net Sales $5.5B +13% year over year | Net Earnings $491M +1% year over year | Adj EBITDA* $1.13B +8% year over year | |||||||||

EPS $3.22 +4% year over year | Adj EPS* $3.55 +11% year over year | Cash Flow from Operations $710M | Free Cash Flow* $497M | |||||||||

| * | Represents a non-GAAP financial measure. See Annex A for reconciliations of GAAP and non-GAAP financial measures. |

4 |

|

| 2022 Proxy Summary |

Environmental, Social and Governance Highlights

Sustainability Is in Everything We Do and Fueling Our Growth

At SEE, environmental sustainability is integrated in our business strategy. Our priorities and commitments represent what we believe is important for creating a future that is more sustainable.

Accelerating the Advancement of a Circular Economy

We are working to achieve our 2025 Sustainability and Materials Pledge aimed to increase materials circularity in the industry through innovation, reducing plastic and other materials waste and collaborating for change.

Investment in Innovation. Dedicating innovation, research and development resources to design or advance packaging materials to be recyclable or reusable and contain more recycled and or renewable content.

Reduce Plastic and Other Materials Waste. Committing to ambitious targets of recycled content across all packaging solutions which maximize post-consumer recycled content.

Collaborate for Change. Building strategic partnerships, combining talent, resources and experience to scale solutions that drive a circular economy. SEE is a member of the following methods:Alliance to End Plastic Waste and an active participant in the American Chemistry Council.

Mitigating Climate Change

Sealed Air has set a goal to reach net-zero carbon emissions for its global operations by 2040. The Company will continue to reduce Scope 1 and 2 carbon emissions through investments in renewable energy and by increasing efficiencies across its operations.

Preserving Resources

We focus on reducing water use, energy use, and waste in our operations and throughout the supply chain while innovating, manufacturing and delivering high-performance packaging solutions.

SEE Ventures — Investing in a Sustainable Future

SEE Ventures is part of our capital allocation strategy focused on investing in early-stage disruptive technologies and new business models for growth. Our SEE Ventures investment portfolio includes those that advance plastic recycling and a circular economy.

SEE Caring, High-Performance Culture

At Sealed Air, we are developing a caring, high-performance culture that is guided by our purpose and focuses on creating long-term value for our stakeholders and society.

Culture Council Leading Transformation

In 2021, the Company created the Culture Council to assist in leading our culture transformation. The Culture Council is focused on executing six workstreams designed to further embed our high-performance culture throughout our organization.

Diversity, Equity and Inclusion: promoting a diverse, equitable, trusting and inclusive culture for all employees.

SEE Operating Engine: capturing our transformation successes into an operating engine that continues to reinvent our business from within.

Operational Excellence: pursuing continuous improvement opportunities.

SEE Academy: nurturing a learning culture that thrives on personal growth and development, strengthening our capabilities to deliver world-class results.

2022 Proxy Statement | 5 |

| 2022 Proxy Summary |

Total Wellbeing and Experience: strengthening our people through total wellbeing, physical and mental health, social, career, financial and community impact.

Community Impact: establishing a framework and resources to encourage active involvement in global philanthropic efforts, to empower local community engagement and to scale social impact in our communities.

Diversity, Equity and Inclusion Strengthening Our Culture

On our journey to world class, we are committed to creating a diverse workplace where each person feels valued and respected. Our individual, unique perspectives and inclusive culture will make our world better than we find it. It’s our responsibility to help drive the change we want to see. We are pledging to:

| ✓ |

|

| ✓ |

|

|

| ✓ | Increase gender diversity across employees globally to more than 30% by 2025 |

| ✓ | Increase the representation of racial and ethnic minorities in our United States workforce to above 35% by 2025 |

| ✓ | Build a more inclusive culture with our employees across the globe |

As of December 31, 2021, 25% of our global employee base are female and 34% of our U.S. workforce belong to racial and ethnic minority groups. We provide our consolidated EEO-1 report and additional information on our diversity, equity and inclusion actions on our website at https://www.sealedair.com/company/our-company/diversity-equity-and-inclusion.

6 |

|

| 2022 Proxy Summary |

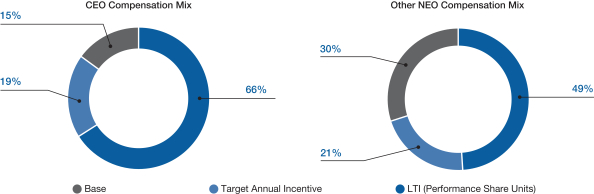

Governance Best Practices | ||

We operate on a strong governance foundation |

✓ Adopted the “Rooney Rule,” which requires women and minority candidates to be included in the pools from which nominees for the Board are considered ✓ Majority voting standard for director elections, with resignation policy ✓ Seven of eight director nominees are independent, including the Chairman of the Board ✓ Independent Audit, Nominating and Corporate Governance, and Organization and Compensation Committees ✓ Oversight of environmental, social and governance matters assigned to the Nominating and Corporate Governance Committee ✓ Oversight of matters relating to corporate culture, employee engagement, diversity, equity and inclusion assigned to the Organization and Compensation Committee ✓ Robust risk oversight by the Board and its committees ✓ Annual Board and committee self-evaluations ✓ Regular executive sessions of independent directors ✓ Mandatory retirement policy for directors ✓ Proxy access rights ✓ Stock ownership guidelines for directors and executives ✓ Orientation for all new directors and ongoing director education programs | |

Pro-Active Stockholder Engagement

We regularly engage with current and prospective stockholders. In 2021 we engaged with stockholders representing approximately 64% of our outstanding shares, and we discussed subjects such as long-term strategy, financial performance, acquisitions and divestitures, major trends and issues affecting the Company’s businesses, industry dynamics, executive compensation, sustainability, and environmental, social and governance matters. See “Executive Compensation—Compensation Discussion and Analysis—2021 Say-on-Pay Vote & Stockholder Outreach” for more information regarding stockholder engagement efforts relating to our executive compensation program.

The Nominating and Corporate Governance Committee oversees the Company’s stockholder engagement activities. The feedback received from our stockholder engagement efforts is communicated to and considered by the Board, and our engagement activities have produced valuable feedback that helps inform our decisions and our strategy, when appropriate.

Code of Conduct and Ethics as the Foundation of Our Culture

Our Code of Conduct was approved by the Board and applies to our directors, officers, employees, suppliers and other third-party business partners. Our employees are required to review the Code of Conduct annually and affirm their adherence in writing. Employees receive regular online education as part of enhanced global ethics and compliance programs. This training includes required and monitored courses for employees in specific roles based on associated risk and function. The topics of online courses include the Code of Conduct, anti-bribery, anti-corruption, conflicts of interest, workplace respect and others. The Integrity Committee, with executive and senior leader membership, oversees the Company’s ethics and integrity programs. The Audit Committee regularly receives updates on matters relating to such programs.

2022 Proxy Statement | 7 |

| 2022 Proxy Summary |

Additional information on our environmental, social and governance efforts is available on our website at www. sealedair.com/company/sustainability.

Proposal 1. Election of Directors

Nominees

We are asking stockholders to elect the following eight director nominees. Each of the nominees currently serves as a director of Sealed Air. Information in the table is as of April 14, 2022.

| Name | Occupation | Director Since | Independent | Other Registered Investment Co. Boards | ||||||

|

Elizabeth M. Adefioye

Age 54 |

Chief People Officer of Emerson Electric Co. |

March 2022 |

✓ |

0 | |||||

|

Zubaid Ahmad

Age 60 |

Founder and Managing Partner at Caravanserai Partners, LLC |

2020 |

✓ |

0 | |||||

|

Françoise Colpron

Age 51 |

Group President, North America of Valeo SA |

2019 |

✓ |

0 | |||||

|

Edward L. Doheny II

Age 59 |

President and CEO of Sealed Air |

2017 |

1 | ||||||

|

Henry R. Keizer

Age 65 |

Retired Deputy Chairman and COO of KPMG |

2017 |

✓ |

2 | |||||

|

Harry A. Lawton III

Age 47 |

President and CEO of Tractor Supply Company |

2019 |

✓ |

1 | |||||

|

Suzanne B. Rowland

Age 60 |

Retired Group Vice President, Industrial Specialties, of Ashland Global Holdings, Inc. |

2020 |

✓ |

2 | |||||

|

Jerry R. Whitaker

Age 71 |

Retired President of Electrical Sector-Americas, Eaton Corporation |

2012 |

✓ |

1 |

8 |

|

| 2022 Proxy Summary |

Nominee Composition

Nominee Skills and Experience

|  |  |  |  |  |  |  | |||||||||||

| Executive Leadership | • | • | • | • | • | • | • | • | |||||||||

| Global Business | • | • | • | • | • | • | • | • | |||||||||

| Finance and Accounting | • | • | • | • | • | • | |||||||||||

| Manufacturing and Industry Experience | • | • | • | • | • | • | • | ||||||||||

| Environmental and Sustainability | • | • | • | • | |||||||||||||

| Strategic Planning | • | • | • | • | • | • | • | • | |||||||||

| Corporate Governance | • | • | • | • | • | • | • | ||||||||||

| Risk Management | • | • | • | • | • | • | • | • | |||||||||

| Technology, Science and Innovation | • | • | • | • | • | • | |||||||||||

| Human Resources | • | • | • | • | • | • | • | ||||||||||

2022 Proxy Statement | 9 |

PROXY SUMMARY

| 2022 Proxy Summary |

Director NomineesProposal 2. Ratification of Appointment of Independent Auditor for 2022

We are asking stockholders to ratify the Audit Committee’s retention of PricewaterhouseCoopers LLP, an independent registered public accounting firm, as our independent auditor to examine and report on our consolidated financial statements and the effectiveness of our internal control over financial reporting for the fiscal year ending December 31, 2022.

Proposal 3. Approval of 2021 Executive Compensation on an Advisory Basis

We are asking for stockholder approval, on an advisory basis in accordance with SEC rules, of the 2021 compensation of our “named executive officers” as disclosed under “Executive Compensation” in this Proxy Statement, including the disclosures set forth thereunder in “—Compensation Discussion and Analysis” and the compensation tables and related narrative discussion.

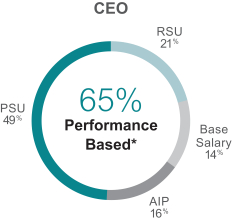

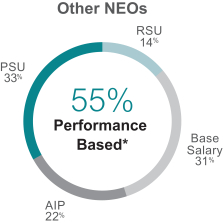

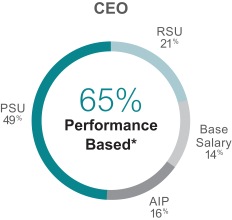

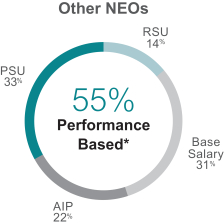

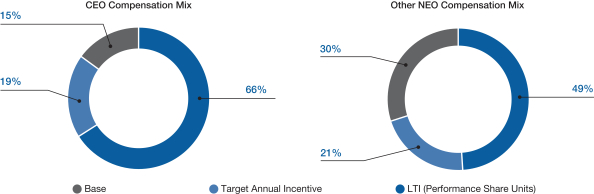

2021 Executive Total Target Direct Compensation Mix

* “Performance-Based” means AIP + PSU

| Name | Age | Director Since | Occupation | Experience/ Qualifications | Independent | Committee Memberships | Other Company Boards | |||||||||||||||||

| Yes | No | |||||||||||||||||||||||

Michael Chu | 67 | 2002 | Managing Director of | ● Leadership | X | ● Organization and | ● Arcos Dorados | |||||||||||||||||

| IGNIA Fund, Senior | ● Global | Compensation | ||||||||||||||||||||||

| Advisor of Pegasus | ● Finance | |||||||||||||||||||||||

| Capital and Senior | ||||||||||||||||||||||||

| Lecturer at Harvard | ||||||||||||||||||||||||

| Business School | ||||||||||||||||||||||||

Lawrence R. Codey | 71 | 1993 | Retired President | ● Leadership | X | ● Audit | ● Horizon Blue Cross Blue | |||||||||||||||||

| and COO of PSE&G | ● Government | Shield of New Jersey | ||||||||||||||||||||||

● Finance | ● New Jersey Resources | |||||||||||||||||||||||

| Corporation | ||||||||||||||||||||||||

Patrick Duff | 58 | 2010 | General Partner of | ● Leadership | X | ● Audit | ||||||||||||||||||

| Dunham Partners, LLC | ● Finance | ● Nominating and Corporate | — | |||||||||||||||||||||

● Education | Governance (Chair) | |||||||||||||||||||||||

Jacqueline B. Kosecoff | 66 | 2005 | Managing Partner of | ● Leadership | X | ● Nominating and Corporate | ● athenahealth, Inc. | |||||||||||||||||

| Moriah Partners, LLC | ● Industry | Governance | ● STERIS Corporation | |||||||||||||||||||||

| and senior advisor | ● Global | ● Organization and | ||||||||||||||||||||||

| to Warburg Pincus | Compensation (Chair) | |||||||||||||||||||||||

Neil Lustig | 54 | 2015 | CEO of Sailthru, Inc. | ● Leadership | X | ● Nominating and Corporate | — | |||||||||||||||||

● Innovation | Governance | |||||||||||||||||||||||

● Industry | ● Organization and | |||||||||||||||||||||||

| Compensation | ||||||||||||||||||||||||

Kenneth P. Manning | 74 | 2002 | Chairman | ● Leadership | X | ● Audit | ● Sensient Technologies | |||||||||||||||||

of Sensient Technologies | ● Industry ● Global | ● Nominating and Corporate Governance | Corporation | |||||||||||||||||||||

| Corporation | ||||||||||||||||||||||||

William J. Marino | 72 | 2002 | Retired Chairman, | ● Leadership | X | ● Chairman of the Board | ● Sun Bancorp, Inc. | |||||||||||||||||

| President and CEO | ● Industry | ● WebMD Health Corp. | ||||||||||||||||||||||

| of Horizon Blue | ● Governance | |||||||||||||||||||||||

| Cross Blue Shield of | ||||||||||||||||||||||||

| New Jersey | ||||||||||||||||||||||||

Jerome A. Peribere | 61 | 2012 | President and | ● Leadership | X | — | ● Xylem Inc. | |||||||||||||||||

| CEO of Sealed | ● Global | |||||||||||||||||||||||

| Air Corporation | ● Industry | |||||||||||||||||||||||

Richard L. Wambold | 64 | 2012 | Retired CEO of | ● Leadership | X | ● Organization and | ||||||||||||||||||

| Reynolds/Pactiv | ● Industry | Compensation | ||||||||||||||||||||||

| Foodservice and | ● Global | |||||||||||||||||||||||

| Consumer Products | ||||||||||||||||||||||||

Jerry R. Whitaker | 65 | 2012 | Retired President of | ● Leadership | X | ● Audit (Chair) | ● Matthews International | |||||||||||||||||

| Electrical Sector-Americas, Eaton | ● Global ● Finance | ● Nominating and Corporate Governance | Corporation | |||||||||||||||||||||

| Corporation | ||||||||||||||||||||||||

|  |

10 |

|

| 2022 Proxy Summary |

PROXY SUMMARY

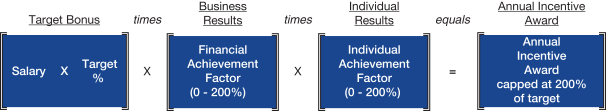

Key FeaturesElements of Our Executive Compensation Program

Key Features

The following table summarizes the main components of our executive compensation program for our named executive officers.

Compensation | Description | Objectives | ||

Base Salary | Fixed cash compensation based on role and duties | Appropriate level of market based fixed pay Assist with recruitment and retention | ||

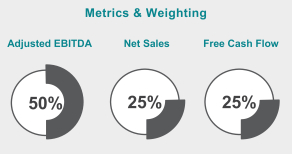

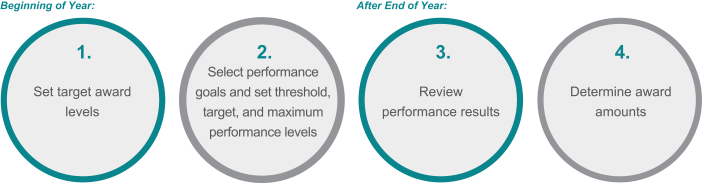

Annual Incentive | Annual cash award based on company financial performance with 0%-200% payout Company, business unit and individual goals may also be considered | Reward executives for driving superior operating and financial results over a one-year timeframe Create a direct correlation between business success and financial reward | ||

Long-Term Incentives | 70% PSUs earned based on performance, typically over three-year period with 0%-250% payout 30% time-vesting RSUs vesting annually over three years | Reward achievement of longer-term goals and value creation Create direct correlation between longer-term business success and financial reward Encourage retention and ownership | ||

Retirement Plans | 401(k) and Profit-Sharing Plan Non-qualified deferred compensation plan | Provide retirement income and wealth creation for participants Assist with recruitment and retention | ||

Severance Benefits | Executive Severance Plan, with reasonable severance benefits | Assist with recruitment and retention | ||

Other Benefits | Health care and life insurance programs Limited perquisites | Competitive with peer companies Assist with recruitment and retention |

2022 Proxy Statement | 11 |

| 2022 Proxy Summary |

Key Compensation Policies and Practices

The Organization and Compensation Committee believes that our executive compensation program follows best practices aligned to long-term stockholder interests, as summarized below:

What We Do | ||||

|

| |||

|

| Use multiple, balanced | ||

|

| |||

|

| Multiple of base salary

| ||

|

| Recovery of annual or long-term incentive compensation based on achievement of financial results that were subsequently restated due to error or misconduct, regardless of whether the | ||

|

| Compensation consultant | ||

| Under our equity compensation plans, vesting following a change in control requires involuntary termination of employment | |||

| ||||

| Consistent with focus on | |||

× |

| Consistent with focus on performance-oriented environment and commitment to best practices aligned to long-term stockholder interests | ||

× |

| Consistent with focus on performance-oriented environment and commitment to best practices aligned to long-term stockholder interests | ||

× |

| |||

PROXY SUMMARY

|

Compensation Components

The main components of our executive compensation program for U.S. employees, including for our named executive officers, are set forth in the following table. A more detailed description is provided in the Compensation Discussion and Analysis.

| ||||

|

| |||

| Corporate Governance |

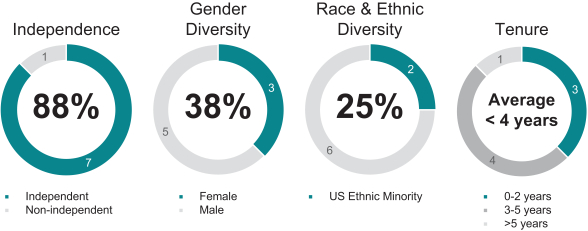

Under our Bylaws and the Delaware General Corporation Law, our business and affairs are managed by or under the direction of the Board of Directors, which delegates some of its responsibilities to its Committees. The Nominating and Corporate Governance Committee of the Board periodically reviews the size of the Board to ensure that the number of directors most effectively supports our Company. We have a strong commitment to diversity of background and experience among our directors, as described below under “— Board Diversity” and “Proposal 1. Election of Directors — Director Qualifications.”

Board Leadership Structure

Jerry R. Whitaker Age: 71 Director Since: 2012 Occupation: Retired President of Sector-Americas, Eaton Corporation |

Notwithstanding the appointment of a Chairman, the Board considers all of its members responsible and

| |||

|

| |||

|

The Board believes having an independent Chairman is beneficial because it ensures that management is subject to independent and | |||

|

| |||

|

|

PROXY SUMMARY

Independence of Directors

2015 Executive Total Direct Compensation MixUnder our Corporate Governance Guidelines adopted by the Board and the requirements of the New York Stock Exchange, or NYSE, the Board of Directors must consist of a majority of independent directors. The Board annually reviews the independence of all non-employee

directors. The Board has established categorical standards consistent with the corporate governance standards of the NYSE to assist it in making determinations of the independence of Board members. We have posted a copy of our Standards for Director and Executive CompensationIndependence on our website at https://ir.sealedair.com/corporate-governance/highlights. These categorical standards require that, to be independent, a director may not have any material relationship with Sealed Air. Even if a director meets all categorical standards for independence, the Board reviews other relationships with Sealed Air in order to conclude that each independent director has no material relationship with Sealed Air either directly or indirectly.

2015 DIRECTOR COMPENSATION TABLEThe Board has determined that the following director nominees are independent: Elizabeth M. Adefioye, Zubaid Ahmad, Françoise Colpron, Henry R. Keizer, Harry A. Lawton III, Suzanne B. Rowland and Jerry R. Whitaker. The Board has also determined that Michael P. Doss and Neil Lustig, who are current directors but are not standing for re-election

| Director | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Total ($) | |||||||||

Hank Brown | 24,375 | 0 | 24,375 | |||||||||

Michael Chu | 95,000 | 100,024 | 195,024 | |||||||||

Lawrence R. Codey | 95,000 | 100,024 | 195,024 | |||||||||

Patrick Duff | 110,000 | 100,024 | 210,024 | |||||||||

Jacqueline B. Kosecoff | 27,500 | 185,039 | 212,539 | |||||||||

Neil Lustig | 87,500 | 100,024 | 187,524 | |||||||||

Kenneth P. Manning | 102,500 | 100,024 | 202,524 | |||||||||

William J. Marino | 136,000 | 160,008 | 296,008 | |||||||||

Richard L. Wambold | 95,000 | 100,024 | 195,024 | |||||||||

Jerry R. Whitaker | 110,000 | 100,024 | 210,024 | |||||||||

PROXY SUMMARY

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||

Jerome A. Peribere | 2015 | 1,180,188 | 0 | 6,918,394 | 0 | 31,800 | 8,130,382 | |||||||||||||||||||||

| President and Chief Executive Officer | 2014 | 1,150,000 | 0 | 10,775,959 | 0 | 37,200 | 11,963,159 | |||||||||||||||||||||

| 2013 | 1,016,667 | 0 | 6,158,787 | 900,000 | 226,383 | 8,301,837 | ||||||||||||||||||||||

Carol P. Lowe | 2015 | 613,500 | 0 | 1,195,493 | 418,662 | 106,772 | 2,334,427 | |||||||||||||||||||||

| Senior Vice President and Chief Financial Officer | 2014 | 585,844 | 0 | 2,147,601 | 562,394 | 43,296 | 3,339,134 | |||||||||||||||||||||

| 2013 | 540,313 | 0 | 908,602 | 449,507 | 24,481 | 1,922,903 | ||||||||||||||||||||||

Emile Z. Chammas | 2015 | 501,025 | 0 | 807,579 | 395,093 | 62,607 | 1,766,304 | |||||||||||||||||||||

Senior Vice President, Chief Supply Chain Officer | 2014 | 477,480 | 0 | 1,542,639 | 530,732 | 286,498 | 2,837,349 | |||||||||||||||||||||

| 2013 | 437,100 | 0 | 967,459 | 0 | 34,606 | 1,439,165 | ||||||||||||||||||||||

Karl R. Deily | 2015 | 502,863 | 0 | 914,505 | 351,371 | 63,425 | 1,832,164 | |||||||||||||||||||||

| Vice President, President Food Care | 2014 | 470,500 | 0 | 1,642,171 | 456,287 | 44,233 | 2,613,292 | |||||||||||||||||||||

| 2013 | 410,000 | 0 | 724,591 | 357,268 | 25,974 | 1,517,833 | ||||||||||||||||||||||

Ilham Kadri | 2015 | 433,695 | 0 | 713,078 | 346,062 | 378,795 | 1,871,360 | |||||||||||||||||||||

Vice President, President Diversey Care | 2014 | 433,073 | 0 | 1,542,576 | 466,807 | 131,753 | 2,574,209 | |||||||||||||||||||||

| 2013 | 466,567 | 0 | 734,203 | 355,597 | 198,458 | 1,754,825 | ||||||||||||||||||||||

Advisory Vote to Approve Our Executive Compensation

Wethe Board at the 2022 Annual Meeting, are asking for stockholder approvalindependent, and that Dr. Jacqueline B. Kosecoff, who retired from the Board effective as of the compensation of our named executive officers as disclosed in this proxy statement in accordance with SEC rules, which disclosures include the disclosures under “Executive Compensation—Compensation Discussion and Analysis,” the compensation tables and the narrative discussion following the compensation tables.

The Audit Committee has approved the retention of Ernst & Young LLP, an Independent Registered Public Accounting Firm, as the independent auditor of Sealed Air to examine and report on the Company’s consolidated financial statements and the effectiveness of the Company’s internal control over financial reporting for the fiscal year ending December 31, 2016, subject to ratification of the retention by the stockholders at the Annual Meeting.

Notice of Annual Meeting of Stockholders

of

Sealed Air Corporation

We will hold the2021 Annual Meeting of Stockholders, was independent while she served as a director.

2022 Proxy Statement | 13 |

| Corporate Governance |

Board Oversight of Strategy

Oversight of Sealed Air Corporation,Air’s business strategy and planning is a Delaware corporation, on May 19, 2016 at 10:00 a.m., Eastern Time, at Crowne Plaza Charlotte Executive Park at 5700 Westpark Drive, Charlotte, North Carolina 28217.key responsibility of the Board. The purposes for the Annual Meeting areBoard has dedicated one Board meeting each year to electan in-depth review of Sealed Air’s entirelong-term strategic plan. The Board also regularly reviews strategy-related matters at other Board meetings throughout the year, such as key market trends, innovation and the competitive landscape. To monitor management’s execution of Directors, to provide for an advisory voteSealed Air’s strategic goals, the Board receives regular updates and is actively engaged in dialogues with management.

Board Oversight of the stockholders to approve our executive compensationSustainability and Environmental, Social and Governance (ESG) Matters

We recognize sustainability and ESG as disclosed in the attached proxy statement, to ratify the appointment of the independent auditor ofstrategic business imperatives at Sealed Air and have made them an integral part of our strategy and business. Recognizing the importance of these matters, the Board designated the Nominating and Corporate Governance Committee with the responsibility of overseeing our sustainability strategies and other matters concerning ESG and public policy issues affecting Sealed Air. The Board also designated the Organization and Compensation Committee with the responsibility of overseeing our workforce and people management strategies, including matters relating to transactcorporate culture, employee engagement, and diversity, equity and inclusion in furtherance of our ESG related strategies.

The Board is highly engaged in assessing sustainability and ESG matters affecting Sealed Air. The Board and its committees regularly discuss Sealed Air’s sustainability and ESG matters with management. In 2021, such other businessdiscussions included matters related to corporate culture, sustainability and circular economy, carbon neutrality, climate and natural disaster responses, diversity, equity and inclusion, employee health and safety, materiality assessment, stakeholder engagement, community impact, as may properly come before the meeting. The individual proposals are:well as ESG reporting and governance.

For highlights of our ESG initiatives, see “2022 Proxy Summary—Environmental, Social and Governance Highlights.”

Board Oversight of Risk

The Board of Directors is actively involved in oversight of risks that could affect Sealed Air. The Board has fixeddelegated oversight of certain specific risk areas to Committees of the closeBoard. For example, the Audit Committee oversees cybersecurity risk management as well as our major financial risk exposures and the steps we have taken to monitor and control such exposures, while the Organization and Compensation Committee considers risks arising in connection with the design of business on March 21, 2016the Company’s compensation programs and succession planning. The risk oversight responsibility of each Board Committee is described in its committee charter available at https://ir.sealedair.com/corporate-governance/committee-composition. The Board as a whole, however, is responsible for oversight of our risk management processes and our enterprise risk management program. The Board regularly discusses risk management with management and among the record datedirectors during meetings.

Cybersecurity risk oversight is a top priority for the determinationBoard. While the Board has delegated the specific responsibility of stockholders entitledcybersecurity risk oversight to noticethe Audit Committee, the Board is actively involved in overseeing cybersecurity risk management, both through presentations given by management during Board meetings as well as regular reports from the Audit Committee on its cybersecurity risk oversight activities. Normally, management is scheduled to provide cybersecurity updates at one Board meeting and three Audit Committee meetings each year. Sealed Air maintains a security awareness program that includes annual mandatory training, frequent phishing simulations, and acknowledgment of information security and acceptable use policies. Furthermore, individuals supporting the information security program are required to vote at the Annual Meeting.

We have sent or made available a copy of our 2015 Annual Report to Stockholders to all stockholders of record. Additional copies are available upon request.

We invite you to attend the meeting so that management may discuss business trends with you, listen to your suggestions, and answer any questions that you may have. Because it is important that as many stockholders as possible be represented at the meeting, please review the proxy statement promptly and carefully and then vote. You may vote by following the instructions for voting set forth on the Notice of Internet Availability of Proxy Materials or on your proxy card, or if you receive a paper copy of the proxy card by mail, you may complete and return the proxy cardhold certifications demonstrating proficiency in the accompanying postage-paid, addressed envelope. If you attend the meeting, you may vote your shares personally even though you have previously voted by proxy.

The only voting securitiessupport of the Company are the outstanding shares of its common stock, par value $0.10 per share. The Company will keep a list of the stockholders of record at its principal office at 8215 Forest Point Boulevard, Charlotte, North Carolina 28273 for a period of ten days prior to the Annual Meeting.

On behalf of the Board of Directors,

NORMAN D. FINCH JR.

Vice President, General Counsel

relevant technologies and Secretary

Charlotte, North Carolina

April 8, 2016

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to be held on May 19, 2016

Please note that the Company’s Notice of Annual Meeting of Stockholders, Proxy Statement for the Annual Meeting of Stockholders and 2015 Annual Report are available at:

http://proxyreport.sealedair.com

14 |

|

| ||||

| ||||

| ||||

The Board has been actively engaged in overseeing management’s response to the COVID-19 pandemic. Since the onset of the pandemic, COVID-19 has been a recurring topic at Board meetings.

Questions and Answers about the Annual MeetingBoard Diversity

Most stockholders will not receive printed copiesOur Board is committed to seeking director candidates to achieve a mix of directors that enhances the proxy materials unless they request them. Instead, we have mailed a Noticediversity of Internet Availability of Proxy Materials that will tell you how to accessbackground, skills and review all of the proxy materialsexperience on the Internet. The notice also tells you how to vote on the Internet. If you would like to receive a paper or e-mail copy of our proxy materials, you should follow the instructions for requesting such materials in the notice.

Our Proxy Statement for the 2016 Annual Meeting; and

Our 2015 Annual Report to Stockholders, which includes our audited consolidated financial statements.

If you requested or receive printed versions of these materials by mail, these materials also include the proxy card for the Annual Meeting.

The ten nominees are:

Michael Chu

Lawrence R. Codey

Patrick Duff

Jacqueline B. Kosecoff

Neil Lustig

Kenneth P. Manning

William J. Marino

Jerome A. Peribere

Richard L. Wambold

Jerry R. Whitaker

Advisory vote to approve our executive compensation; and

Ratification of Ernst & Young LLP as our independent registered public accounting firm for 2016.

Beneficial owners of shares held in “street name” may vote by following the voting instructions provided to you by your bank or broker or other nominee.

You may also vote in person at the Annual Meeting as described below.

http://proxyreport.sealedair.com

voting via the Internet or telephone at a later time;

submitting a properly signed proxy card with a later date; or

voting in person at the Annual Meeting.

If you hold shares of the Company through Sealed Air’s Profit-Sharing Plan or Sealed Air’s 401(k) Thrift Plan, please refer to the next question and answer.

|

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. Thisage, gender, international background, race, ethnicity and specialized experience.

We recently formalized our longstanding commitment to Board diversity by adopting the “Rooney Rule,” under which the Board is referredcommitted to seeking out qualified diverse candidates, including women and minority candidates, to include in the pools from which nominees for the Board are considered.

Since 2019, we have added three new female directors and two new ethnic minority directors to the Board. Our director nominees represent 38% in gender diversity and 25% in race and ethnic diversity.

Board Meetings, Committee Membership and Attendance

The Board generally holds four regular meetings per year and meets on other occasions when circumstances require. Directors spend additional time preparing for Board and Committee meetings, and we may call upon directors for advice between meetings. We encourage our directors to attend director education programs.

Under our Corporate Governance Guidelines, we expect directors to regularly attend meetings of the Board and of all Committees on which they serve and to review the materials sent to them in advance of those meetings. We also expect nominees for election at each annual meeting of stockholders to attend the annual meeting. All of our directors who were then serving as a “broker non-vote.” The only routine matter expected to be voted on atdirector attended the 2021 Annual Meeting is the ratification of the appointment of the independent auditor.Stockholders.

Vote Required for Election or Approval

Sealed Air’s only voting securities are the outstanding shares of our common stock. As of the close of business on March 21, 2016, 196,720,368 shares of common stock were outstanding, each of which is entitled to one vote at the Annual Meeting. Only holders of record of common stock at the close of business on March 21, 2016, the record date, will be entitled to notice of, and to vote at, the Annual Meeting. A majority of the outstanding shares of common stock present in person or represented by proxy and entitled to vote on any matters to be considered at the Annual Meeting will constitute a quorum for the transaction of business at the Annual Meeting. For the purpose of determining a quorum, we will treat as present at the meeting any proxies that are voted on any matter to be acted upon by the stockholders, as well as abstentions or any proxies containing broker non-votes.

Election of Directors: Majority Vote Requirement

Each director will be elected by a vote of the majority of the votes cast with respect to that director, where a majority of the votes cast means that the number of shares voted “for” a director must exceed the number of votes cast “against” the director. We will not count shares voted to “abstain” for the purpose of determining whether a director is elected. Similarly, broker non-votes will not have any effect on the outcome of the election of directors since broker non-votes are not counted as “votes cast.” Under the Company’s Certificate of Incorporation, its Bylaws and the Delaware General Corporation Law, a director holds office until a successor is elected and qualified or until his or her earlier resignation or removal. If any of the nominees that is currently in office is not elected at the Annual Meeting, then the BylawsOur Corporate Governance Guidelines provide that the director shall offer to resign from our Board of Directors. The Nominating and Corporate Governance Committee will make a recommendation to our Board whether to accept or reject the resignation, or whether other action should be taken. Our Board will consider and act onmeet regularly in executive session without management in attendance. The Chairman of the recommendationBoard presides at each executive session. The Chairman’s designee or the chair of the Nominating and Corporate Governance Committee and publicly disclose its decision andserves as the rationale behind it within 90 days frompresiding director if the dateChairman of the certificationBoard is unable to serve.

During 2021 the Board held seven meetings. Each current director attended at least 95% of the election results. The director who offers his or her resignation will not participate in the decisionaggregate number of meetings of the Board and all committees of the Board on which he or she served during 2021.

2022 Proxy Statement | 15 |

| Corporate Governance |

Board Committees and Membership

The Board maintains an Audit Committee, a Nominating and Corporate Governance Committee, orand an Organization and Compensation Committee. The members of these Committees consist only of independent directors. The Board also maintains an Executive Committee, which is comprised of the Chairman of the Board serving as chair of Directors. Ifthe Executive Committee, the CEO and the chairs of the other standing Committees. The Executive Committee may act on behalf of the Board when convening a meeting of Directors accepts such resignation, thenthe full Board is impractical. The Executive Committee did not meet in 2021.

The Board has adopted charters for each of the Committees, which are reviewed annually by the Committees and the Board. The Committee charters are available on our website at https://ir.sealedair.com/corporate-governance/committee-composition.

| 11 Meetings in 2021 | ||||||||

| Henry R. Keizer Chair Members: Zubaid Ahmad Françoise Colpron Suzanne B. Rowland | The Board has determined that each member of the Audit Committee is independent, as defined in the listing standards of the NYSE, and is financially literate. The Board has also determined that each of Messrs. Ahmad and Keizer is an audit committee financial expert in accordance with the standards of the SEC. No director is eligible to serve on the Audit Committee if that director simultaneously serves on the audit committees of more than two other public companies. The Audit Committee is responsible for: • our internal control system, including information technology security and control • our public reporting processes • the performance of our internal audit function • the annual independent audit of our consolidated financial statements and related disclosure • the quality and integrity of our consolidated financial statements • our legal and regulatory compliance • the retention, performance, qualifications, rotation of personnel, and independence of our independent auditor • related person transactions involving Sealed Air and members of the Board and executive officers Our independent auditor is ultimately accountable to the Audit Committee. The Audit Committee has the ultimate authority and responsibility to select, evaluate, approve terms of retention and compensation of, and, where appropriate, replace the independent auditor. The Audit Committee evaluates the performance of our independent auditor and interviews and has direct involvement in the selection of the lead audit partner in connection with the mandated rotation of such position. | ||||||

16 |

|

| Corporate Governance |

2022 Proxy Statement | 17 |

| Corporate Governance |

| Organization and Compensation Committee | 12 Meetings in 2021 | |||||||

| Françoise Colpron Chair Members: Michael P. Doss Harry A. Lawton III Neil Lustig | The Board has determined that each current member of the Organization and Compensation Committee, or the Compensation Committee, is independent, as defined in the listing standards of the NYSE. The Compensation Committee is responsible for: • compensation of the executive officers • stockholder review and action regarding executive compensation matters • performance review of our CEO and executive management • succession planning • Sealed Air-sponsored incentive compensation plans, equity-based plans and tax-qualified retirement plans • workforce and people management strategies, including matters relating to corporate culture, employee engagement, and diversity, equity and inclusion in furtherance of the Company’s environmental, social and governance-related strategies The Compensation Committee oversees and provides strategic direction to management with respect to our executive compensation plans and programs. The Compensation Committee reviews our CEO’s performance and compensation with the other non-employee directors. Based on that review, the Compensation Committee evaluates the performance of our CEO and makes all compensation decisions for our CEO. The Compensation Committee may also recommend certain CEO compensation decisions to the Board for further approval by the non-employee members of the Board. The Compensation Committee also reviews and approves the compensation of the other executive officers. The Compensation Committee makes most decisions regarding changes in salaries and bonuses during the first quarter of the year based on company and individual performance during the prior year, as well as relevant commercially available proxy and survey data of peer group companies and companies of comparable size. The Compensation Committee also has authority to grant equity compensation awards under our 2014 Omnibus Incentive Plan, as amended and restated effective May 18, 2021 (the “2014 Incentive Plan”). This award authority has been delegated on a limited basis for awards to employees who are not subject to the requirements of Section 16 of the Securities Exchange Act of 1934 to the Equity Award Committee, comprised of our CEO. | ||||||

18 |

|

| Corporate Governance |

Compensation Committee Interlocks and Insider Participation

Each of Ms. Colpron, Mr. Doss, Mr. Lawton and Mr. Lustig, as well as Dr. Kosecoff, who retired from the Board can filleffective as of the vacancy resulting from that resignation2021 Annual Meeting of Stockholders, served on the Compensation Committee during 2021. During 2021 none of the members of the Compensation Committee was an officer or can reduceemployee of Sealed Air or any of its subsidiaries, and no executive officer of Sealed Air served on the numberboard of directors that constitutes the entire Board of Directors so that no vacancy exists.any entity whose executive officers included a director of Sealed Air.

Advisory Vote to Approve Our Executive CompensationBoard and Committee Evaluations

The advisory voteBoard and each committee annually conduct a self-evaluation to approve our executive compensation must be approved byreview and assess the affirmative voteoverall effectiveness of the holders of a majority ofBoard, each committee and the shares of common stock entitled to vote and present in person or represented by proxy at the Annual Meeting. Abstentions will count as votes against this proposal since sharesdirectors, including with respect to whichstrategic oversight, board structure and operation, interactions with and evaluation of management, governance policies and committee structure and composition. The process includes detailed written surveys as well as individual, private meetings between each director and the stockholder abstains will be deemed presentChairman. Committee self-assessments of performance are shared with the full Board. The Nominating and entitledCorporate Governance Committee also reviews the Corporate Governance Guidelines each year in light of changing conditions and shareholders’ interests and recommends appropriate changes to vote. Broker non-votes will have nothe Board for consideration and approval. Matters with respect to Board composition, the nomination of directors, Board processes and topics addressed at Board and committee meetings are also considered as part of our self-assessment process. As appropriate, these assessments result in updates or changes to our practices as well as commitments to continue existing practices that our directors believe contribute positively to the effect on the outcomefunctioning of this proposal since such shares will not be deemed entitled to vote.our Board and its committees.

Ratification of Ernst & Young LLP as Our Independent Registered Public Accounting firm for 2016

The ratification of Ernst & Young LLP as our independent registered public accounting firm for 2016 must be approved by the affirmative vote of the holders of a majority of the shares of common stock entitled to vote and present in person or represented by proxy at the Annual Meeting. Abstentions will be deemed present and, therefore, will count as votes against this proposal. Because this proposal is considered a routine matter, there will not be any broker non-votes on this proposal.

Any other matters considered at the Annual Meeting must be approved by the affirmative vote of the holders of a majority of the shares of common stock entitled to vote and present in person or represented by proxy at the Annual Meeting.

Corporate GovernanceHedging Policy

Under our Corporate Governance Guidelines and other policies, all Sealed Air Corporation directors, executive officers and certain other key executives are prohibited from hedging and speculative trading of Sealed Air securities. They may not purchase or sell puts, calls, options or other derivative securities based on Sealed Air securities and may not enter hedging or monetization transactions such as zero-based collars and forward sale contracts, in which the holder continues to own the underlying security without all the risks or rewards of ownership. In addition, other than permitted loans from our 401(k) plan, such persons may not purchase Sealed Air securities on margin or borrow against any account in which Sealed Air securities are held, subject, in the case of executive officers and other key executives, to exceptions as may be granted by the Organization and Compensation Committee.

Corporate Governance GuidelinesMaterials

The Board of Directors has adopted and operates under Corporate Governance Guidelines that reflect our current governance practices in accordance with applicable statutory and regulatory requirements, including those of the SEC and the NYSE. The Corporate Governance Guidelines are available on our web sitewebsite atwww.sealedair.comhttps://ir.sealedair.com/corporate-governance/highlights.

Under theIn addition to our Corporate Governance Guidelines, and the requirements of the NYSE, the Board must consist of a majority of independent directors. The Board annually reviews the independence of all non-employee directors. The Board has established categorical standards consistent with theother information relating to corporate governance standards of the NYSE to assist it in making determinations of the independence of Board members. We have attached a copy of our current director independence standards to this Proxy Statement as Annex A and also posted a copyat Sealed Air is available on our web sitewebsite atwww.sealedair.comhttps://ir.sealedair.com/corporate-governance/highlights. These categorical standards require that, to be independent, a director may not have a material relationship with the Company. Even if a director meets all categorical standards for independence, the Board reviews other relationships with the Company in order to conclude that each independent director has no material relationship with the Company either directly or indirectly.

The Board has determined that the following director nominees are independent: Michael Chu, Lawrence R. Codey, Patrick Duff, Jacqueline B. Kosecoff, Neil Lustig, Kenneth P. Manning, William J. Marino, Richard L. Wambold and Jerry R. Whitaker. In evaluating the independence of the non-employee director nominees, the Board considered the following transactions, relationships or arrangements:

Mr. Manning is the Chairman and a director of Sensient Technologies Corporation. In 2015, Sealed Air Corporation and all of its subsidiaries paid approximately $357,971 to Sensient and its affiliates for colors and other products. Sealed Air sold to Sensient and its affiliates goods and services in an amount totaling approximately $236,195 during 2015. These relationships are expected to continue at approximately the same levels during 2016. In 2014, Sealed Air Corporation and all of its subsidiaries paid approximately $270,809 to Sensient and its affiliates for colors and other products. Sealed Air sold to Sensient and its affiliates goods and services in an amount totaling approximately $307,215 during 2014. The fees paid to Sensient during 2014 and 2015 have been substantially less than 2% of Sensient’s consolidated gross revenues.

Mr. Lustig served as the President and Chief Executive Officer of Vendavo Inc. from August 2007 through October 2014. In February 2014, Vendavo entered into an agreement with Deloitte Consulting to act as a subcontractor to Deloitte in connection with Deloitte’s professional services engagement with Sealed Air. This contract served to engage Vendavo’s consultants to implement the SAP Price and Margin Management software modules for Sealed Air. In 2014, Sealed Air paid Deloitte Consulting approximately $3,368,380 for such work. Shortly after Mr. Lustig’s departure from Vendavo on October 30, 2014, the contract with Deloitte was cancelled and replaced with a direct agreement between Vendavo and Sealed Air. Mr. Lustig was not involved in any way with this renegotiation. In 2015, Sealed Air paid Vendavo approximately $1.2 million for such work. The fees paid to Vendavo, directly or indirectly, during each of the years 2013, 2014 and 2015 have been less than 2% of Vendavo’s consolidated gross revenues. Mr. Lustig remained an advisor to Vendavo from October 2014 through October 2015. In exchange for these advisory services, Mr. Lustig received a modest stock option grant.

For many years, we have had a, including our: (i) Bylaws; (ii) Code of Conduct applicable to the Companyall directors, officers and employees of Sealed Air and its subsidiaries. The Code of Conduct applies to all of our employees and to our officers and directors. We also have a supplementalsubsidiaries; (iii) Code of Ethics for Senior Financial Executives that applies to our Chief Executive Officer, Chief Financial

Officer, Controller, Treasurer,Executives; (iv) Related-Person Transactions Policy and all other employees performing similar functions. We have posted the texts of the Code of Conduct and the Code of EthicsProcedures; (v) Standards for Senior Financial Executives on our web site atwww.sealedair.com. We will post any amendmentsDirector Independence; (vi) Qualifications for Nomination to the Code of ConductBoard; and the Code of Ethics(vii) Policy and Procedure for Senior Financial Executives on our web site. In accordance with the requirements of the SEC and the NYSE, we will also post waivers applicable to any of our officers or directors from provisions of the Code of Conduct or the Code of EthicsStockholder Recommendations for Senior Financial Executives on our web site. We have not granted any such waivers.

The Board is actively involved in oversight of risks that could affect the Company. While the Audit Committee oversees our major financial risk exposures and the steps we have taken to monitor and control such exposures, and the Organization and Compensation Committee considers the potential of our executive compensation programs to raise material risksNominations to the Company, the Board as a whole is responsible for oversight of our risk management processes and our enterprise risk management program. The Board regularly discusses risk management with Management and among the Directors during meetings.Board.

2022 Proxy Statement | 19 |

| Corporate Governance |

Stockholders and other interested parties may communicate directly with the non-management directors of the Board of Directors by writing to

Non-Management Directors

c/o Corporate Secretary at Sealed Air Corporation 8215 Forest Point

2415 Cascade Pointe Boulevard

Charlotte, North Carolina 28273, 28208

or by sending an email todirectors@sealedair.com. In either case, the Chairman of ourthe Board will be notified of all such correspondence as appropriate and will communicate with the other directors as appropriate about the correspondence. We have posted information on how to communicate with the non-management directors on our web sitewebsite atwww.sealedair.com.https://ir.sealedair.com/corporate-governance/contact-the-board.

20 |

|

Mr. Marino was elected as the Chairman of

| Certain Relationships and Related-Person Transactions |

Under our Corporate Governance Guidelines, the Board of Directors in May 2014. The Chairman presides at meetings of the Board of Directors at which he is present and leads the Board of Directors in fulfilling its responsibilities as specified in the Bylaws. The Chairman has the right to call special and emergency meetings. The Chairman serves as the liaison for interested parties who request direct communications with the Board of Directors.